Amazon was born in 1994, and for nearly 30 years thereafter, its strong brand power and high-quality service have always been its top weapons for dominating the global e-commerce market. Taking logistics services as an example, according to data released by Amazon, in 2023 it provided Prime members with the fastest delivery service in history worldwide, with over 7 billion items delivered on the same day or the next day.

In 2024, Amazon also plans to further improve delivery efficiency. It is reported that it will continue to reshape its operational network and leverage the power of artificial intelligence to more accurately predict and respond to user needs, as well as optimize the layout of product storage. At the same time, Amazon plans to further expand its coverage of daily deliveries and upgrade its inventory layout and structure with intelligence.

Although brand strength and service quality are still emphasized by Amazon today, this established e-commerce platform is also trying to try more "new things". Recently, there have been reports that Amazon will launch a new low-cost vertical website called Bazaar in the Indian market. It is reported that Bazaar will mainly sell low-priced white label clothing, watches, shoes, jewelry, as well as fashionable daily necessities such as suitcases, with a single item price of less than 600 Indian rupees (about 7.24 US dollars), and has started accepting sellers to join. In terms of delivery time, Bazaar may provide a delivery service of two to three days.

It is obvious that Bazaar means that Amazon will start exploring the sinking market. The reason for its current attempt is also simple, that is, the scale of the sinking market is huge, and SHEIN and TEMU, which focus on cost-effectiveness and low-priced brands, are too aggressive.

SHEIN, which has been working hard for 10 years, goes without saying that with its unique small order fast return flexible supply chain system, it was previously considered the most successful domestic enterprise in the cross-border e-commerce field for a considerable period of time. Moreover, since 2023, SHEIN has also begun to promote platformization and expand into comprehensive cross-border e-commerce platforms, and has launched a "buy buy buy" model to support platformization strategies and expand into offline scenarios.

As an emerging platform, TEMU, which has positioned itself as a comprehensive e-commerce platform since its debut, has achieved an unprecedented growth rate. In just one year, TEMU has landed in over 40 countries and regions. Previously, sources revealed that TEMU's GMV for the full year of 2023 may reach $14 billion, and it may have set a GMV target of $30 billion for 2024. Among them, in Amazon's headquarters in the US market, relevant data shows that TEMU's GMV has already approached SHEIN in September 2023.

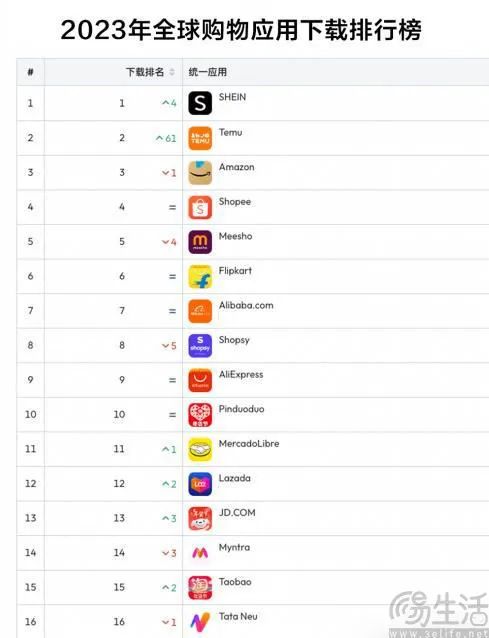

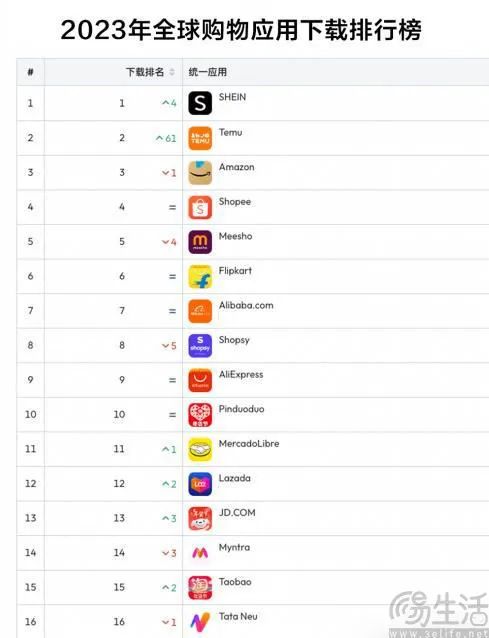

According to the 2024 Mobile Market Report released by market analysis firm data.ai, after topping the global shopping app download chart in 2022, SHEIN once again became the world's top downloaded shopping app in 2023, followed closely by TEMU, while Amazon could only rank third.

Although Amazon's fourth quarter and full year financial reports for 2023, released in February this year, showed that it successfully reversed its net loss of $2.7 billion in 2022 and achieved a good result of a 12% year-on-year increase in revenue. But upon closer examination, it is not difficult to find that Amazon's outstanding performance in 2023 is inseparable from its relentless efforts to cut costs throughout the year. Official data shows that the net profit in 2021 was $33.36 billion, almost the same as $30.43 billion in 2023, but Amazon's revenue in 2021 was only $469.8 billion, about $105 billion less than in 2023. In other words, Amazon's profitability has not returned to its previous level.

In summary, although Amazon's absolute size is still very large, and brand and service are still the main advantages, with SHEIN and TEMU's low-priced strategy sweeping the world, it has also forced them to rethink their ways of coping.

In fact, looking back at the past, it is not difficult to find that Amazon has already planted clues for exploring the sinking market. Previously, in December 2023, Amazon announced a significant reduction in seller commissions. For example, in the clothing category, the commission rate for products priced below $15 has been reduced to 5%, while the commission rate for products priced between $15 and $20 has been reduced to 10%. Prior to this, the commission rates for both categories were 17%. It should be noted that "low-priced" clothing priced below $20 is precisely the area that Amazon is most influenced by SHEIN and TEMU. Therefore, it is difficult to say that such a significant reduction in commission is not to allow merchants to offer more attractive prices to users.

So why is Amazon going to start anew and launch a brand new platform to explore the sinking market? One important reason for this is that the elephant may find it difficult to turn around, which is that Amazon needs to strike a balance between maintaining its existing advantages and exploring the potential to lower its brand image in lower tier markets.

As for why Amazon chose India as its first stop for this exploration, it is because on the one hand, SHEIN was defeated here and was not allowed to enter again until 2023 when it collaborated with Reliance Group. Due to various reasons, TEMU has not yet ventured into this region. So in this way, Amazon still has the potential to take the lead.

On the other hand, according to a report released by management consulting firm BainCompany in 2023 on the Indian e-commerce market, over 70% of local e-commerce consumers are from the middle and low-income groups in second - and third tier cities, who are enthusiastic about shopping on low-priced e-commerce platforms. Moreover, from 2020 to 2022, the market share of such e-commerce platforms has increased fivefold. In addition, BainCompany's report also points out that the current e-commerce sales in the Indian market only account for 5% -6% of the total retail sales, and there is still a lot of room for exploration. In other words, the Indian market with clear user needs and predictable incremental growth is almost the best choice for Amazon's exploration.

Of course, if Amazon wants to explore India as its first stop in the sinking market, in addition to SHEIN and TEMU, it also needs to face competition from local platforms such as Flipkart, Meesho, Nykaa, Snapdeal, and Myntra. Among them, Meesho is known as the "Indian version of Pinduoduo" and currently mainly relies on white label products, low prices, and zero commission models, targeting local second and third tier cities. According to the relevant data released by Data.ai, Meesho's cumulative download volume on Google Play and App Store in June 2023 has exceeded 500 million times, making it one of the fastest-growing shopping applications in the world and the first profitable e-commerce platform in India.

So ultimately, the sinking market is already a pressing issue for Amazon, but it remains to be seen where it can go and whether it can continue to maintain high-speed growth.

News

News